How Insurance Agencies Can Focus on Sales by Outsourcing Virtual Assistants

Insurance agencies spend considerable time on non-sales activities such as data entry, form-filling, meeting appointments, compliance paperwork, and responding to requests from customers. Agents spend 30% to 50% of their time on administrative responsibilities. One study found agents spend 30% of the day on administrative work. Another study found that 57% of insurance professionals spend more than half their time on non-sales activities. All of this is “back-office burden” that takes agents away from doing what they do best: meeting prospects, closing sales, and building client relationships. However, if agents could delegate these administrative responsibilities to virtual assistants (VAs), they could gain hours each week to prospect, and sell more policies, generating millions in new revenue for agencies. In short, outsourcing virtual assistants can help an agency get back to the business of making sales.

The Sales-vs-Admin Dilemma in Insurance Agencies

Insurance agents have dozens of tasks to perform throughout each day that include writing renewals, processing claims, ordering underwriting reports, filing and retrieving policies, assisting clients, and selling or renewing existing policies. This can cause burnout. Costly mistakes can occur. Opportunities can be missed. One agency calculated that saving each agent even 2 hours per day can yield over $4 million in additional revenue per year. This is because it allows agents to handle more policies and prospects.

Outsourcing virtual assistants addresses this imbalance by taking over non-revenue tasks. Specialized VAs – often trained in insurance processes – can manage back-office work so producers can focus on closing deals. Studies suggest a small productivity boost (even 20%) can dramatically raise revenues and client satisfaction. By delegating paperwork and routine duties, P&C agencies empower agents to concentrate on their core mission: sales and client relationships.

What Insurance Virtual Assistants Do

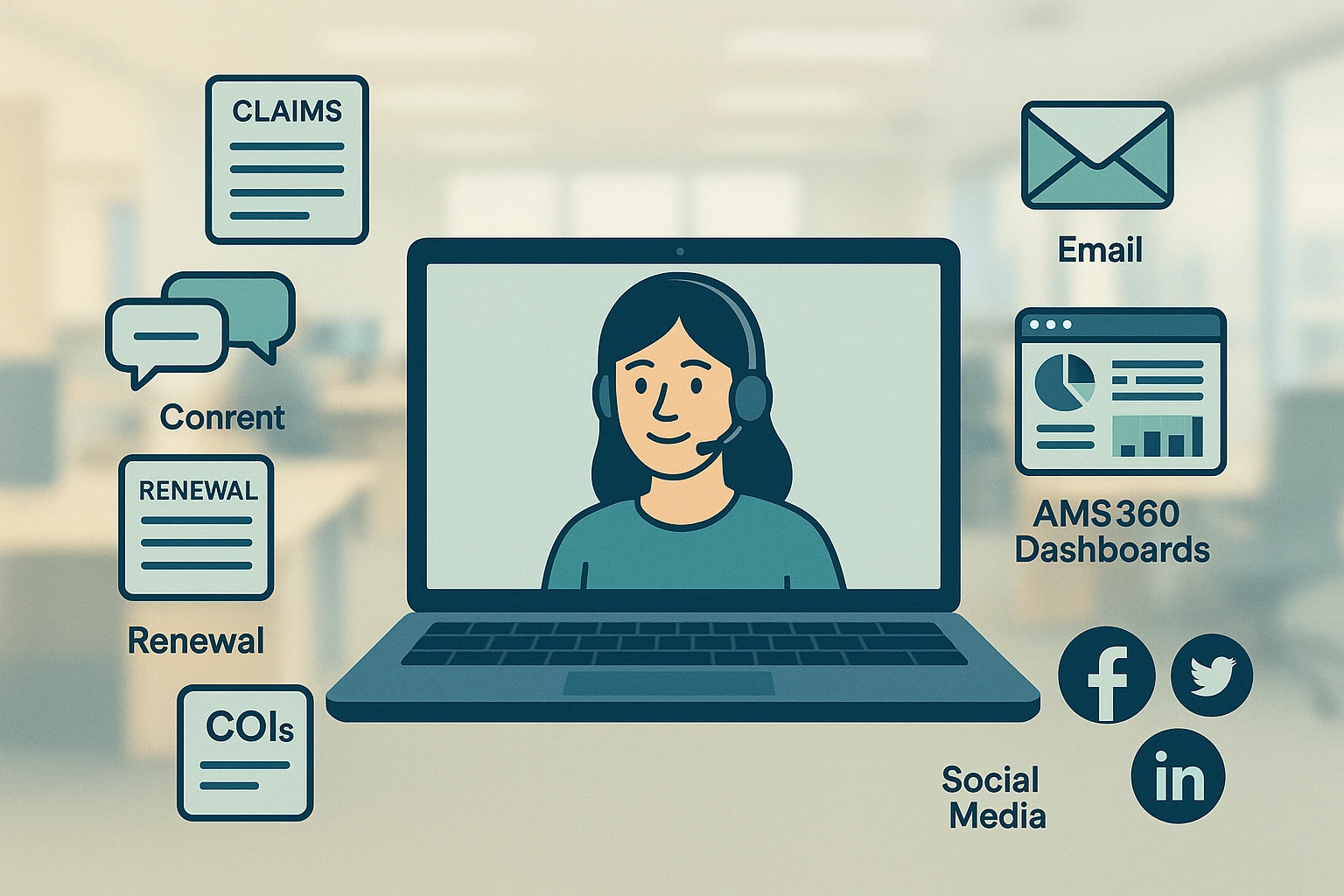

By outsourcing virtual assistants, agencies can delegate insurance-related administrative and support tasks. Unlike generic VAs, these specialized assistants often have experience or training in industry tools (AMS360, Applied Epic, AgencyZoom, etc.). Common tasks handled by insurance VAs include:

- Policy and Claims Support: Completing claims paperwork, following up with carriers, tracking claims paperwork, and preparing policy renewals or endorsements.

- Client Contact: Routine client calls get answered. Emails get answered. Appointments or reviews for clients get scheduled. Reminders get followed up with via email or phone.

- Enter new leads within agency management systems: Update the status with a policy or claim. Ensure the accuracy for information related to clients and policies. Generate invoices and reports.

- Document & Email Management: filing of quotes, applications, certificates of insurance (COIs), endorsements, as well as handling correspondence and distribution of documents by email, fax, or e-portal.

- Sales Support: Arranges prospect calls/meetings, return calls for referrals, research work for quotes, or other lead generation work.

- Marketing: Making posts to social media, creating email newsletters and updating webpages to attract and keep clients.

These duties “might seem minor alone, but together they can consume 10–20+ hours per week” for agents. Offloading them by outsourcing virtual assistants not only frees up calendars, but also improves responsiveness and service quality.

Insurance VAs thus become an extension of the team: integrating with in-house staff and systems. They follow the agency’s processes, access cloud tools, and even manage specialized platforms (claims portals, e-cert tools, quote comparison software). When chosen correctly, a VA requires minimal training on basic tools and immediately starts adding value.

Key Benefits of Outsourcing Virtual Assistants

There are several advantages for P&C insurance agents in outsourcing virtual assistants and focusing on growing their business, such as the following:

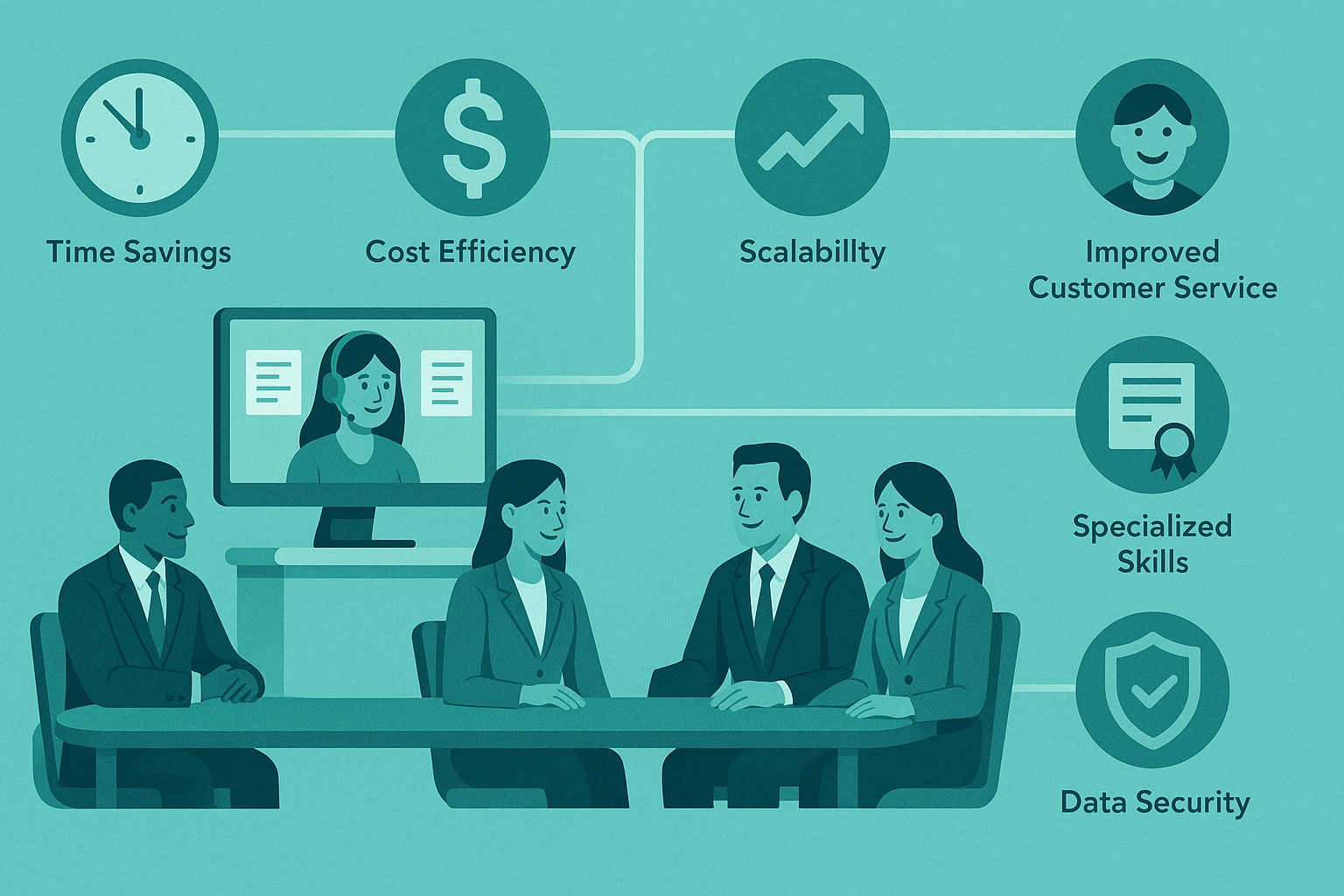

- Huge Time Savings & Productivity: When agencies outsource data entry, email triage, and scheduling, producers can focus on revenue-generating activities. Our partners have proven systems and state-of-the-art technology that allow partners to perform administrative responsibilities more quickly and efficiently than an in-house resource can do, especially when that resource is stretched thin. This operational efficiency provides meaningful cost and productivity benefits in total.

- Cost-Effective: By outsourcing the VAs and paying per hour, you are not paying for salaries. You are not paying for employee benefits. You are not paying for equipment or an office space. Full-time employees earn a salary and also require recruiting, training, insurance, tax, and real estate expenses. Using VAs means you are paying per hour or a flat fee per plan, and many agencies find that offshore VAs utilizing prices of $5-10/hour perform the same work.

- Scalability and Flexibility: Agencies can easily scale the number of virtual assistants needed upon demand. For example, at times in year when clients go through large renewals, new systems implementations, or marketing campaigns, staffing levels may also need to increase. You can reduce support immediately when things get slow, thus eliminating delays and costs that normally arise when hiring and laying off staff.But according to outsourcing consultants, more than 80% of executives expect to maintain or increase their outsourcing spending, showing the flexibility of VA teams.

- Improved Customer Service: VAs often field simple questions and accomplish routine tasks 24/7. By outsourcing virtual assistants, agencies can provide customer service support at any hour. Outsourced teams can work around the clock to address queries, and customers know somebody will respond. This results in happier customers with better retention, since status inquiries or renewal reminders aren’t lost. In short, better back-office support means better client satisfaction.

- Access to Specialized Skills: Outsourcing taps into a global talent pool. Many VA providers hire insurtech-trained employees that already have experience working within the insurance industry. Working with a prominent VA company gives your credit union access to specialized certified professionals (claims, underwriting support, regulatory compliance, even multilingual service) that are hard to find locally.

- Data Security & Compliance: The best VA service providers have confidentiality agreements. The assistants are guided by applicable laws and data security protocols. Offshore vendors offering outsourcing virtual assistants are familiar with handling sensitive data (including PHI, HIPAA, and PCI) so the customer does not need to be worried about the legal compliance and the professional services can be delivered.

Each of these benefits combines to let agencies relentlessly focus on sales. A recent industry report notes that roughly 65% of small businesses now outsource at least one VA function, reflecting how mainstream virtual support has become. Even large firms are outsourcing front-office roles to gain agility. In property-casualty (P&C) insurance – a $1+ trillion market in the U.S. – such productivity gains can have huge impact.

Real-World Impact: Stats and Case Studies

The numbers are compelling. The global virtual assistant outsourcing market is booming – valued at roughly $20–25 billion in 2025 and expected to nearly double by 2030 (CAGR ~7–9%). In the U.S. in particular, a significant share of this growth comes from finance and insurance: agencies and carriers are increasingly outsourcing virtual assistants for tasks like customer support, policy servicing, and lead follow-ups to VAs.

Case Study – Agent Productivity: A Covu study illustrates the payoff: Imagine a three-person agency. If each agent saves just 2 hours per day by offloading admin, and each sells 2 more policies daily (at $2,800 average premium), the agency could generate over $4 million more annually. That’s real additional revenue unlocked by giving agents extra client-facing hours.

Market trends: show that 56% of SMBs have outsourced administrative responsibilities. Global market research claims that 50% of VA business comes from scheduling, email, accounting/bookkeeping, and marketing. VAs are used in healthcare to book patient appointment times and submit claims to health insurers. In contrast to their customary perception of being administrative support, VAs are seen as an extension of the team, allowing in-house team members to spend more time ideating, conceptualizing and problem-solving.

Comparison – In-House vs Outsourced: The difference is dramatic. In-house staff require recruitment time, salaries, benefits, workspace, equipment and training – all fixed costs. Outsourced VAs eliminate those burdens. You simply pay for the support you need, when you need it. In practice, agencies report cutting office and payroll costs by tens of thousands per year and boosting agent time on sales.

| Aspect | In-House Staff | Outsourced VA Service |

| Recruiting & Training | Longer, more costly hiring (recruiters, ads, checks) | VAs are pre-vetted and often insurance-trained |

| Salary & Benefits | Includes salary benefits and taxes for full-time | Pay only for hours worked, no benefits needed |

| Office & Equipment | Requires desks, computers, software licenses, and insurance. | VAs mostly work remotely and use their own cloud-based apps. |

| Flexibility & Scalability | Fixed headcount; slow to scale | Scale up/down instantly for peak workloads |

| Agent Focus | Agents split time (sales and admin) | Agents focus on sales and client meetings |

| Productivity Tools | Depends on internal tools and processes | Outsourcer provides best practices, AI tools |

| Data Security | Controlled on-site (but staff may lack protocols) | Professional VAs follow strict compliance protocols |

This comparison shows why insurers are rapidly adopting VAs. According to the 2025 industry outlook, remote staffing is already a big opportunity: one-third of the US workforce are expected to be remote by 2028, meaning that agencies need access to a global talent pool and outsourcing virtual assistants is simply how forward-thinking agencies are adapting their business model for the future.

Overcoming Common Concerns

Agencies new to outsourcing virtual assistants often worry: “Will a VA understand insurance nuances? Can I trust remote staff with data?” These fears are valid but addressable. Reputable VA providers specialize in insurance. Their assistants are trained in compliance, have background in policy servicing or claims, and become experts in the agency’s specific systems. Quality control is built-in: many firms employ QA analysts and regular performance checks to maintain high standards.

Security is likewise managed. Top VA services implement strict confidentiality agreements and use secure technology. For example, one provider emphasizes that its VAs are fully compliant with data security and legal standards. They also align work hours and platforms with your agency’s processes to ensure seamless collaboration. In practice, many clients say they “can’t live without their VA” once they overcome the initial setup.

Another concern is loss of control. Key to success is communication and project management. It is recommended that agencies give their VA clear communication about each task and use a project management tool with their VA (such as Asana, Slack, or an internal VA portal). Some VA companies have a playbook of documented processes. By integrating a VA under a simple management system (or using a VA service’s proprietary platform), agencies can achieve near-instant task delegation without added overhead.

Finally, decision-makers want to see a ROI. For example, one full-time admin employee not hired; for example, an agency saves $30K-$50K annually in salary plus benefits. But if those functions can be covered for a fraction of that cost by outsourcing virtual assistants, the ROI is immediate; sales productivity is improved, clients are retained, and errors are reduced. Indeed, industry data shows that agencies using VAs tend to out-perform agencies with 100% in-house staff.

Choosing the Right Virtual Assistant Partner

Outsourcing is not a simple proposition. Picking the right outsourcing partner is vital. Agencies should look for providers with insurance industry focus and proven track records. Key evaluation points include:

- Expertise: Does the VA service have experience in P&C insurance? Do their assistants know industry terms, compliance requirements, and AMS systems? Ask about past insurance clients.

- Flexible Plans: You should be able to start with small hours (part-time is common) and ramp up. The best providers have short minimum commitments or trial periods..

- Security & Compliance: Check data protection legislation (e.g. HIPAA) and check the vendor’s required non-disclosure agreements (NDAs) and file sharing methods they use to share work files when outsourcing virtual assistants.

- Communication: Your partner should also assign a coordinator or supervisor to support your team, a single point of contact who will work in your time zone and on your tech platforms.

- Quality Assurance: do they record calls and verify data input? Do they monitor their performance? Do they report on completed work regularly and meeting SLAs?

- Cultural Fit: If using offshore VAs, make sure they are professional and have a good command of English, and check reviews or references from US insurance clients.

Agencies can also prepare internally by documenting their own processes first – a clear SOP manual accelerates onboarding of any VA. Some firms even provide an “outsourcing playbook” to help new clients get started smoothly.

Taking the first step is easy. Many VA companies that specialize in outsourcing virtual assistants offer free consultations or matching services. You can discuss your specific pain points (claims backlog? too many COI requests? slow renewal turnaround?) and have the provider recommend a custom support plan. With the right VA by your side, you’ll find administrative headaches gradually disappear, replaced by more time to grow the agency.

Conclusion – Reclaim Your Sales Focus Today

Outsourcing virtual assistants lets P&C agencies shift from firefighting to focused growth. By offloading grunt work, agents can spend more hours meeting clients, managing broker relationships, and closing business – exactly what drives profitability. As remote staffing becomes the norm (U.S. Bureau of Labor projects one-third of the workforce will be remote by 2028), savvy agencies are already leveraging VAs for competitive advantage.

If your team is buried in admin, now is the time to explore outsourcing virtual assistants. Every week spent on paperwork is a week not spent on sales. Contact a specialized insurance VA provider today to discuss your needs. With skilled VAs handling your back-office tasks, you’ll finally have the time and energy to focus on what matters most: growing your book of business and serving more clients.

Want to keep reading? Discover more articles on topics that matter to you.